In recent years, many contractors have observed a troubling trend: their workers’ compensation Experience Modification Rate (EMR) has been on the rise, despite stable or improved loss experiences. This phenomenon raises an important question: why are EMRs increasing when the underlying claim costs appear unchanged?

In recent years, many contractors have observed a troubling trend: their workers’ compensation Experience Modification Rate (EMR) has been on the rise, despite stable or improved loss experiences. This phenomenon raises an important question: why are EMRs increasing when the underlying claim costs appear unchanged?

What is EMR and how is it calculated?

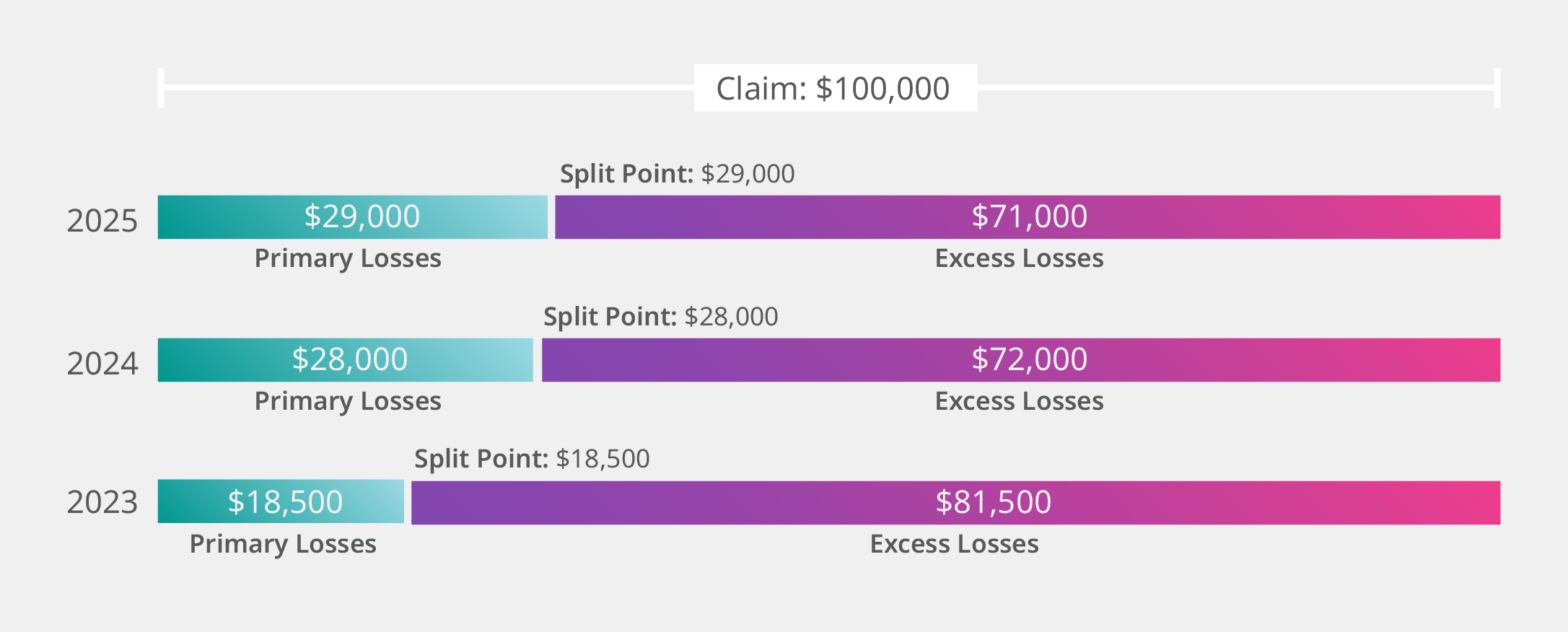

The EMR is a critical metric that compares an employer’s actual claim costs to the expected claim costs set by the National Council on Compensation Insurance (NCCI). The calculation involves a split point, which is the threshold that divides claim costs into primary and excess portions. When the split point increases, a larger share of claim costs is allocated to primary losses, which can lead to a higher EMR if all other factors remain constant.

Primary losses are given a much greater weight than excess losses in the calculation of a client’s experience modification rating (EMR). Using a $100,000 claim in Illinois as an example:

Reasons behind the increase in split points

The recent increases in split points can largely be attributed to inflation and rising medical costs. As medical expenses have surged, the NCCI aims to ensure that the primary portion of claim costs accurately reflects these current costs. Additionally, the NCCI has noted a historical decline in claim frequency, prompting a shift in focus from frequency to the severity of individual claims.

Moreover, the NCCI has reduced the per claim accident limit in many states, which is the maximum amount a claim can contribute to the EMR for severity. For instance, Illinois saw a decrease from $485,500 in 2023 to $206,000 in 2024. This adjustment is intended to balance the impact of the increased split point on claim frequency.

The lagging nature of EMR

One of the challenges contractors face is that the EMR is a lagging indicator, often reflecting incidents that occurred 6 to 18 months prior. This delay can result in a higher EMR even when a contractor has improved safety measures. Additionally, inaccuracies in data collection, particularly from owner-controlled insurance programs, can further complicate the EMR calculation.

Navigating EMR challenges

Contractors with an EMR above 1.00 may face difficulties in securing contracts, as many owners and general contractors impose strict EMR requirements. However, demonstrating a proactive approach to managing and reducing EMR can often mitigate these concerns.

To effectively manage EMR in light of the changes, contractors should consider the following strategies:

- Regular claim reviews: Conduct quarterly or semi-annual reviews of all open claims with workers’ compensation adjusters and claim advocates. Focus on claims under the new split point to identify potential cost reductions.

- Timely claim closures: Aim to close claims at least six months before policy renewal to ensure accurate reporting to the NCCI.

- EMR calculations: Have your insurance broker calculate your EMR six months prior to renewal to identify and address any potential issues.

- Error review: Scrutinize the NCCI published EMR worksheet for any errors, as corrections can be made for objective inaccuracies.

Ultimately, the most effective way to maintain a favorable EMR is to foster a safe work environment. By proactively managing claims and understanding the factors influencing EMR, contractors can better navigate the complexities of workers’ compensation and protect their bottom line.