A solution to a hard insurance market

You’ve probably heard―we’re currently experiencing a hard insurance market. One way to reduce costs during a hard market is with alternative risk financing. Captive insurance is a common alternative risk strategy that can provide long-term stability during these turbulent times.

You’ve probably heard―we’re currently experiencing a hard insurance market. One way to reduce costs during a hard market is with alternative risk financing. Captive insurance is a common alternative risk strategy that can provide long-term stability during these turbulent times.

What is a captive? Generally speaking, a captive is a licensed insurance company owned and controlled by its insured(s) which insures or reinsures the risk of its parent(s) or affiliated companies.

Simply put–it’s a formalized mechanism to finance self-insured risk (i.e., if you’re profitable for the insurance companies, it might make sense to evaluate your own risk).

There are two main types of captive structures:

1. Single parent captive: Owned and operated to insure or reinsure the risk of its parent or affiliated companies (one owner).

- Flexibility over structure, coverages, and ownership

- Appropriate for larger organizations retaining significant risk on their balance sheet and have insurance premiums in excess of $2 million

2. Group captive: Insurance entity owned by a group of insureds for the benefit of its owners.

- Restricted to workers’ compensation, general liability, and auto liability

- Ideal for middle-market organizations with a combined premium of $100 thousand–$3 million across the three lines referenced above

- Medical stop-loss captives for employers either fully insured or self-funded under 500 employees

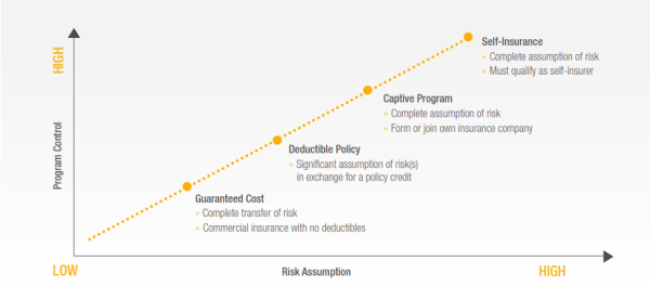

Depending on the size of your organization, a group, single parent captive, or medical stop-loss captive might be an appropriate strategy to consider gaining greater control over your insurance costs. It’s important to remember in the world of captives, you (i.e., the captive owner-insured) will be responsible for all or a large portion of the risk insured through the captive. While this will allow you to exert more control over the claims experience and total cost for your risk management program, the ultimate liability will be your responsibility. However, like traditional insurance companies, captives often retain a quantified amount of risk and transfer severity exposure through reinsurance arrangements, ultimately allowing the captive to profit off the frequency or the predictable claim layer. There’s a spectrum of control vs. risk to keep in mind when determining the best structure of alternative risk financing. The graph below illustrates the spectrum in detail.

If you’re considering a captive for your company, the first step is to understand your risk tolerance. Every business has various exposures that translate into a unique set of risks specific to that organization.

To learn more about captives and which one is right for you, contact a Marsh McLennan Agency advisor to help you evaluate your options.